Over the years, companies both large and small—from FedEx and Microsoft to the local gym—have found themselves in deep water due to the misclassification of contractors. The headlines associated with audits of independent contractor vs. employee relationships have died down recently, but federal and state taxing authorities continue to aggressively pursue these violations. What do you need to know to navigate your role as a freelancer?

What is an independent contractor?

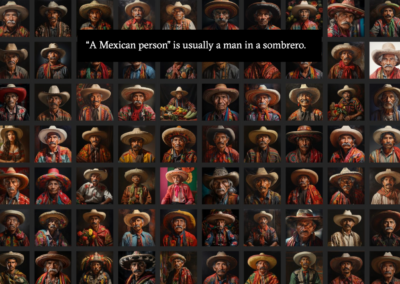

Generally speaking, a “contractor” is a business being hired by a company to perform certain tasks that are outside the core services of the hiring company. The contractor brings specific skills that the hiring company doesn’t have and, therefore, is not directed or controlled by the hiring company but rather is free to perform the tasks based on their expertise. If the role is one where the hiring company wants to manage the “what, when, where and how” of the work, the worker is likely an employee.

Of course, it’s not always clear what constitutes a contractor in the relationship. The Federal requirements are based on the US Supreme Court’s position that there’s no one test to determine whether an employment relationship exists but, rather, that determination is driven by the facts and circumstances. Each state has its own definition, with California’s “ABC Test” being the most definitive. California’s test codifies guidelines for independent contractor status that many other states also have in place, including:

- Freedom from the direction and control of the hiring company,

- Work that is outside the usual course of the hiring company’s business, and

- The contractor customarily engages in business of the same nature as an independently established business.

While the rules differ across jurisdictions, what is consistent across them is that you must operate a business and provide the services independently. As a freelancer, you should have an understanding of these requirements and ensure your relationships with the hiring company reflect “contractor” status.

Why does the government care if you’re an independent contractor vs employee?

You may wonder why this all matters. The distinction between independent contractors and employees exists under both state and federal law to ensure employees core to the business are protected under the law, while allowing businesses the freedom to contract with those who are not core to the business. When a hiring company opts to classify a worker as a contractor instead of an employee, it pays the contractor directly and does not withhold payroll taxes from the pay. The contractor, as a separate business, pays its own taxes on its receipts. If any workers are found to be misclassified, the hiring company is responsible for the back taxes—and penalties.

As the contractor, you are not responsible for these taxes—but beware of contract terms that may obligate you to certain requirements. While a written contract is not necessary for contractor status, it reflects the intent of the parties to be in a contractor relationship. This evidence can be shown to an auditor if the classification is ever questioned or investigated. More important for you, though, is that the written contract provides key terms to protect you and your business. Issues such as the ownership of intellectual property you create, limitations on the potential liability you are exposed to, dispute resolution procedures, and the scope of your services and payment terms are spelled out in the contract. Without written terms, underlying statutory law applies, which may not be in your favor.

Reading your contract carefully

The contract will likely also require you to “represent and warrant” certain things are true. For example, the contract may have you attest that you have a business license, maintain your own office, and file your own taxes as required by federal or state law. You need to be 100% confident that those representations and warranties are factual. Carefully review sections that require you to “indemnify” or “hold harmless” the hiring company from liabilities associated specifically with your employment classification. If you agree to these indemnification provisions, you become responsible for reimbursing the hiring company for costs and damages—possibly including back taxes and penalties—if they arise.

As a freelancer or contractor, it’s important that you have the information to navigate conversations with the hiring company and to understand the provisions of any contract you sign. The contractor relationship should be mutually beneficial, with both parties engaging under the same rules and expectations. You’ll come across as professional if you have the baseline requirements in place and provide the hiring company confidence that the relationship will hold up under the scrutiny of an audit.

Michelle’s Socials: Twitter, LinkedIn

Editor’s Socials – Elisa Camahort Page: Instagram, Twitter, LinkedIn